SIBRO Pay In Master: The Easy Tool for Insurance Brokerage Calculations

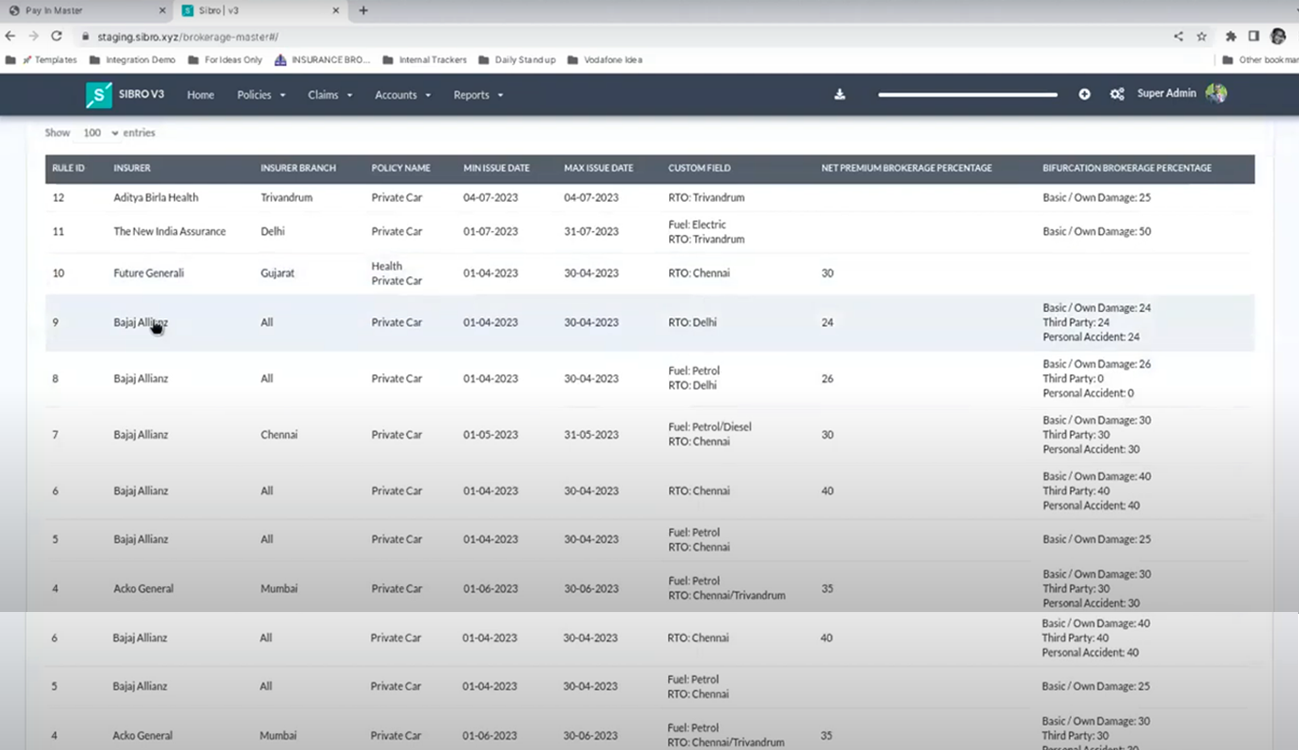

SIBRO v3 stands out as the only software in the market that allows users to create insurer-specific and product-specific parameters while setting Pay In rules based on insurer, product, date range, and other custom conditions. This enables brokers—particularly those managing medium to high-volume, pre-underwritten products—to automate brokerage receivable calculations accurately.

What’s In This Tutorial?

> Feature summary

> Why now?

> Pre-requisites for setting PayIn rules

> Details about the new update

> Video guide explaining the update

> Example for better understanding

> Feature roll-out date

Feature Summary

We’re excited to introduce the Pay In Master feature, the easiest way to streamline brokerage calculations. This feature is designed to automate the calculation of brokerage receivables based on multiple parameters, including insurer, product, date range, and custom conditions.

With Pay In Master, setting up specific rules for each insurer, product type, or unique condition is straightforward. This allows you to ensure accurate and efficient calculations tailored to each scenario. Whether you need insurer-specific rules, product-focused settings, or customized conditions, Pay In Master simplifies the process, saving time and boosting accuracy.

Why now?

The 2023 Commission Regulations introduce a more flexible and unbundled approach to commission payments, removing the caps imposed by the previous framework. This allows insurers to pay higher commissions as they see fit. The regulations also eliminate the previous distinctions between commissions, remuneration, and rewards, simplifying the payment structure and giving insurers more flexibility to incentivize and reward intermediaries.

Additionally, the new regulations treat all insurance intermediaries equally by merging the concept of rewards with commissions. Corporate agents, like banks, are no longer subject to restrictions based on revenue from non-insurance activities. Insurers must still implement a board-approved policy to regulate commission limits, guided by a note issued by the IRDAI on 31 March 2023, which outlines key principles for these policies.

That’s why we introduced this new feature. Pay In Master helps you define brokerage receivable auto calculation rules based on various parameters like Insurer, Product, Date Range, and Custom Conditions.

Pre-requisites

Before defining the PayIn rules, ensure you have the insurer’s grid prepared. Additionally, you must have Master access at User Master to gain entry to the Pay In Master, where you can add and edit PayIn rules. If you are an admin, you can configure these settings by navigating to Settings > Policy > Pay In Master. It’s also important to be well-versed in the concepts of Policy Custom Fields to effectively manage these rules.

About the update

We’re introducing the new Pay In Master feature, designed to simplify and automate the calculation of brokerage receivables based on various parameters such as Insurer, Product, Date Range, and Custom Conditions. With Pay In Master, you can easily define specific rules for different scenarios.

This feature empowers you to create insurer-specific, product-specific, and condition-specific brokerage rules, ensuring accurate and automatic calculations.

Watch the video below to learn how to set up your Pay In Rules and take full advantage of this feature.

Example

For example, the Insurance company ICICI Lombard may say that for Private Car Policies issued in July 2023, they will pay 30% of the Net Premium. For Private Car Policies issued in August 2023, the insurer will pay 27% of the Net Premium.

At the same time, the Insurance company HDFC Ergo may say that for Delhi-based Petrol Private Car Policies issued in July 2023, they will pay 35% of the Net Premium. For Delhi-based Non-Petrol Private Car Policies issued during the same period, the insurer will pay say 18% of the Net Premium.

You can define such Insurer wise, product-wise, custom condition-wise brokerage receiveable rules using the Pay In Rules.

Rollout Date

After thorough testing and refinement, this feature has now been successfully rolled out to all our customers. Starting from August 01, 2024, it is officially available in Sibro V3, offering enhanced functionality and a more seamless experience for users.

Akhil Raju

Author at Protracked Software Solutions